Conflict of Interest Tracking

Protect your firm by detecting and preventing conflicts of interest in real-time.

Track Disclosures in Real-Time

We designed our conflicts of interest tracking system with one thing in mind – automation.

Strengthen your Internal Processes

Our system makes it easy for your representatives to login to the system to add, amend, modify or recertify activities on-the-fly. We also made it easy for your supervisors and compliance administrators by giving them real-time notifications anytime a representative under their supervision goes into the system to change the status of a disclosure. The result: closed-loop compliance.

Flexible Pre-Approval Hierarchy

The system’s approval hierarchy can be set-up to enforce your firm’s unique departmental, branch or divisional workflows. Additionally, there are no limits on the levels of approval needed.

Easy-to-Manage Processing Queue

Once a disclosure is submitted to compliance, the assigned approver can login to the system to review, accept, reject, or comment on the disclosure request, all from one centralized location.

Complete Customization

Every time a disclosure is submitted, completed, modified or commented on, the system will automatically date, time-stamp and record the action in order to maintain a detailed roadmap of each activity.

Disclosure Types

Select from any or all of the following disclosure services.

Outside Brokerage Account

Maintain written notice and consent of your rep’s outside brokerage accounts while creating an audit trail that can be easily accessed at any time.

Gifts And Entertainment

Leverage limit options to control the amount of gift/entertainment expenses your representatives can give or receive, and deny any overages on-the-fly.

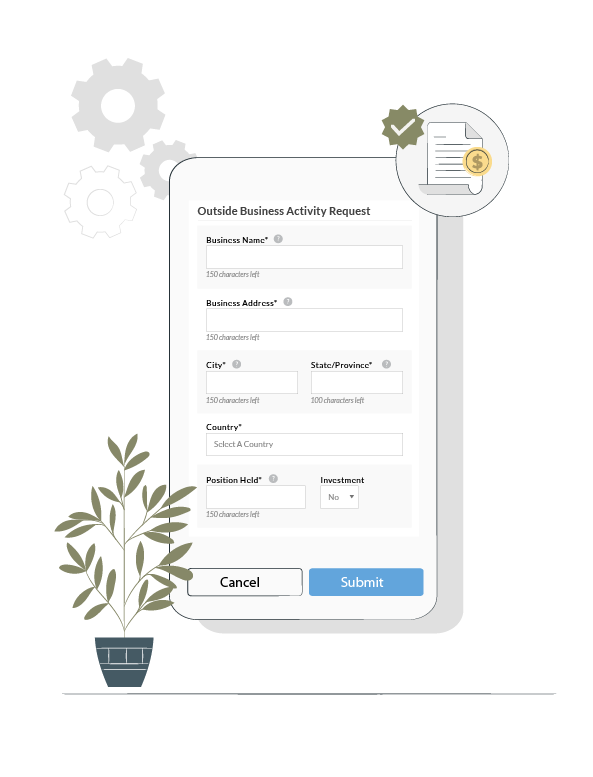

Outside Business Activities

Keep tabs on your representatives’ outside business activities and easily request they “recertify” to any active activities throughout the year.

Private Securities Transactions

Keep tabs on your representatives’ private securities transactions and easily approve, deny or request more information on disclosures submitted.

Advertising Review

Use our standardized form to collect information specific to advertising communication and get pre-approval through the proper checks and balances.

Political Contributions

Monitor your representatives’ political contributions, political activities and campaign financing to prevent influence in any state, federal or local elections.

Social Media Disclosure

Gather a census of your representatives’ active social media profiles and accounts, affirming to regulators that you are monitoring any activity specific to your business.

Correspondence Tracking

Easily manage incoming and outgoing written and electronic communications through an automated process, while tracking each document as it flows through the approval hierarchy.

Activity Logs

Track daily, weekly or monthly activities in accordance with internal processes, procedures and transactions. You can also use the tool to enforce compliance with FINRA Rule 2090 and 2111.

Customer Complaints

Evaluate all written complaints directed towards your firm and/or its registered individuals.

Checks/Securities Received

Properly review, track and maintain records of all securities received and delivered by the firm.

General Disclosure

Create, store and approve/reject your own firm-specific disclosures in the system. We can track everything!

Questionnaire Integration

Tired of duplicating work? Ask us how we can feed disclosures into your ACQ.

Make it One, Fluid Process

Integrate your conflict of interest tracking program with our Annual Compliance Questionnaires to formalize the collection and management of integral U4 data. By standardizing this process, you can streamline many manual steps of document intake and processing to quickly file and submit U4 amendments online.

Contact Us

Submit the form to talk to one of our product specialists!